Fibe Instant Personal Loan App

Do you need quick cash? Then, Fibe Instant Personal Loan App is the ultimate solution. With Fibe, you can get instant cash loan and have the money transferred to your account in just two minutes.

Key Features of Fibe Personal Loan App:

• Instant Loan Amounts: Get instant loans ranging from ₹5,000 to ₹5 lacs, tailored to your needs.

• Personal Loan Tenure: Choose a tenure that suits your convenience, ranging from 3 to 36 months.

• 100% Digital Process: Enjoy our credit line loan app fully digital application process, which eliminates long queues and saves your precious time.

• Minimal Documentation: All you need is your PAN, Aadhaar card, and salary account bank statement.

• No Collateral Required: Get an instant cash loan without being worried about securing collateral.

• No Pre-closure Charges: Pay off your loan early without any additional fees.

Why Choose Fibe?

With over ₹22,500+ crores worth of instant loans disbursed and 6.5 million+ loans approved, Fibe is a name you can rely on. Join our 25 lacs+ satisfied customers who have experienced the convenience of Fibes Personal Loan App.

Example on how Personal loans from Fibe work

• Loan amount: ₹ 50,000

• Processing fee (2% of loan amount * 18% GST): ₹ 1,180

• Total Loan amount: ₹ 51,180

• Interest: 24% p.a. (on reducing principal balance interest calculation)

• Tenure: 12 months

• Your EMI: ₹ 4,840

• Total Amount to be paid: ₹ 4,840 x 12 = ₹ 58,075

• Total interest paid: ₹ 58,075 - ₹ 51,180 = ₹ 6,895

• Total cost of loan: ₹ 6,895 + ₹ 1,180 = ₹ 8,075

• APR (Annual Percentage Rate) : 28.58%

Personal Loan Eligibility Criteria

• Salaried Individuals

• Above 21 years

• Minimum take-home salary per month ₹15K

How do you apply for an instant personal loan on Fibe?

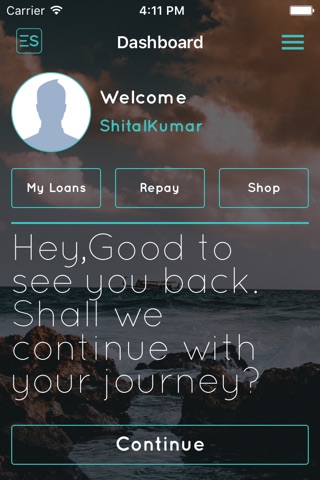

Applying for an instant cash loan is easy on the Fibe-Instant personal loan app. Follow these steps:

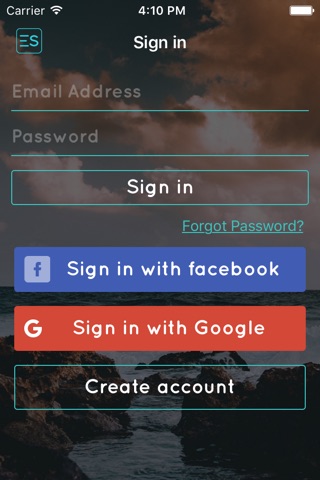

1. Download the Fibe instant personal loan app and log in.

2. Fill in your basic details and upload the required documents.

3. Choose your desired instant loan amount and tenure.

4. Get the money transferred to your account in just 2 minutes.

Instant Cash Loan Fees and Charges

Interest Rate: Starting at 2% per month

Processing Fee: Up to 3% of the loan amount

Bounce Charges: ₹500

APR (Annual Percentage Rate): Ranges from 16.75% to a maximum of 36%(This may vary subject to Tenure)

Late Payment Charges: ₹500 or 3% of the loan amount, whichever is higher, based on the overdue amount

Stamp Duty: 0.1% of the loan amount

Mandate Rejection Charges: ₹250 + GST

Pre-closure Charges: ₹0

At Fibe, we believe in transparency. All fees and charges are clearly communicated to our customers through the agreement shared on their registered email IDs. You can also access your loan details 24/7 through our instant personal loan app.

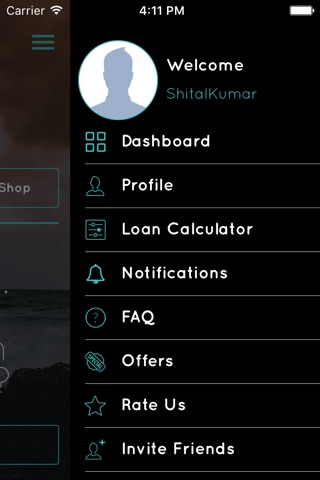

About Fibe (EarlySalary)

Fibe App is owned by Social Worth Technologies Pvt Ltd & facilitates lending services primarily through our RBI registered NBFC arm, EarlySalary Services Pvt Ltd (formerly known as Ashish Securities Pvt. Ltd). It is a financial ecosystem that enables the mid-income group to upgrade their lifestyle. It offers an array of financial products like short-term Instant Cash Loans, long-term Personal Loans, Buy Now Pay Later plans. Fibe has a 100% digital loan application process. Select customers can also avail of the Fibe Axis Bank Credit Card. It is ISO/IEC 27001 certified & its app is PCI DSS compliant & ensures better data security. It won the Best Fintech Startup Award at G20 DIA Mega Summit.

Our Partner NBFCs

• Earlysalary Services Private Limited (Formerly Known as Ashish Securities Private Limited)

• Northern Arc Capital Limited

• Incred Financial Services

• HDB Financial Services

• Vivriti Capital Limited

• Kisetsu Saison Finance (India) Private Limited

• Piramal Capital and Housing Finance Limited

• Aditya Birla Finance Limited

• Cholamandalam Investment & Finance Company Limited (CIFCL)

How to contact Fibe:

Telephone: 020-67639797

Email: [email protected]